I had the privilege of helping to open the Calgary Microcredit Conference this past weekend on a panel with Mark Durieux, University of Calgary, and Rupert Scofield, FINCA where we provided our thoughts to answer the day’s question and conference theme: Microcredit and Beyond – The Emerging Wave of Social Business & Social Entrepreneurship.

On a Saturday morning, two hundred Calgarians turned out to think through the opportunities that microcredit, and more broadly, microfinance, has provided over the past thirty years, and to deal with the challenges that have arisen in the industry. These challenges, which some have harshly critiqued as failures, are in my belief the keys to providing us with early learning as we develop the macro areas of impact investing.

While I only was able to stay for the first half of the conference, I was energized by the diversity of perspectives and participants in the room. For me, even among differences in definitions and in ways of achieving impact, there were three broad threads that tied together thirty years of microfinance learning with the coming wave of “what’s next”.

Social Business

Rupert Scofield’s discussion of his own journey of building FINCA was inspirational to an audience that was hungry to know how they could participate in the world of social business. From MBA students to lifelong Rotarians*, the entrepreneurial spirit of wanting to put hands into action was palpable in the room. For some it was the first time they had heard of microfinance and social business; others started wondering aloud (and on Twitter): how do we establish social business opportunities, education, and support here in Calgary?

Network of Do-ers

As new opportunities in social business and impact investing emerge, we sometimes overlook legacy organizations, like Rotary International, who have the ability to bring together both their 1.2 million strong, global network, as well as partner with like-minded organizations to make sure the work at the ground-level is getting as much attention as the theoretical, promotional work of our sector. At a local level, the conference was a great way to see the blending of microfinance and social entrepreneurship, and to witness the ability of a network like Rotary in connecting do-ers across the world.

Creating Proximity

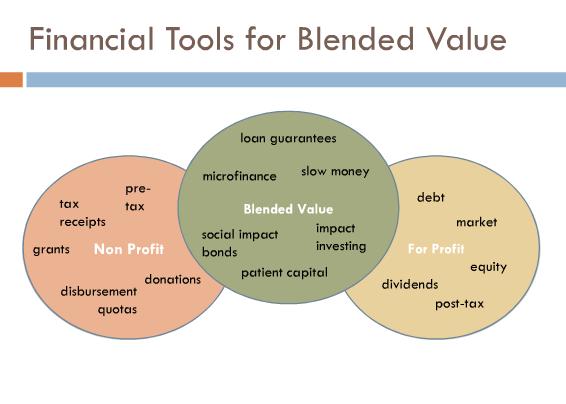

The remarks I made during the day stayed in the lofty place of organizational systems and financial tools. They are essential; they are the mechanisms by which we get this work done – but they are too technical to really get to the heart of the work, which I believe is to create better proximity between us and the root issues.

Doris Olafsen of Opportunity International and Legacy Kitchens highlighted the need to create proximity in their morning discussion on the continuing importance of microcredit. In their eyes, microcredit is much more than a financial tool; it is the ability to create proximity. Being able to connect with the work of microfinance is not just important for the CEO or a Program Officer of a microfinance institution, but for all levels of the organization. The same holds true for networks like Rotary. People are changed when they are able to put their hands to work, when they know they have a stake in the game.

What’s Next?

I was unfortunate to miss out on the afternoon portion of the day, where the presenters represented great organizations like Oiko Credit, MicroEnsure, and the Grameen Foundation. There is a rich history in the thirty years of microfinance that we in social entrepreneurship and impact investing have the opportunity to learn from. The debate between social impact and financial return was a palpable undercurrent throughout the day, and the conference programme showed its preference. It would have been interesting and thought-provoking to have organizations such as SKS Microfinance included in the line-up as well. For me, knowing “what’s next” means really understanding what has come before and, part of my takeaway is that, perhaps, we aren’t quite finished with where we’re at right now.

*The conference was hosted by the Rotarian Action Group for Microcredit.